The thrill of college acceptance is unlike anything else in the world. Seniors hold their breath as they hit the refresh button on the admission status portal. The loading circle’s never-ending spin suddenly halts … “Congratulations!” Blank stares reflect on the luminescent screen at this one word. It starts as floating on cloud nine, but then this fantasy is shattered. The culprit? Tuition price. That dream-turned-reality school could cost anywhere from $13,000 a year for a UC to upwards of $40,000 for a private institution. Student debt poses an issue for most seniors across the United States.

A few students are able to gain full-ride scholarships through athletics or merit, but this is not the case for most. The vast majority are left with the question: Can I even afford to go here? Thankfully, options to overcome this roadblock exist in the form of financial aid. The most common way to acquire it is through a governmental process called FAFSA.

FAFSA, or the Free Application for Federal Student Aid, is an official form that students use to apply for federal financial aid. Colleges and career schools use the information submitted to determine how much financial aid a student is eligible to receive through grants, scholarships, funds, and loans.

There are two types of aid that FAFSA can give: need-based and non-need-based aid, either individually or as a combination of the two. There are many types of need-based financial aid. Federal Pell Grants are the main federal grants for college and do not have to be paid back. Federal Supplemental Educational Opportunity Grants are just like Pell Grants, but available to fewer schools. Federal Direct Subsidized Loans, where students do not have to pay interest, also exist. Federal Work-Study is slightly different from the rest, providing part-time jobs that are made available through participating higher-education institutions. All forms of these need-based financial aid are granted through the completion of FAFSA.

Non-need-based financial aid includes three main types: direct unsubsidized loans which require students to pay interest, Federal PLUS Loans which are intended for parents or graduate students, and TEACH grants which are given to teachers-in-training.

With so many increasing opportunities for students, the important thing to remember is that FAFSA itself is not a loan or free money, but simply a form that students can fill out to determine their aid eligibility. The deadline for the 2023-2024 FAFSA application is June 30, 2024. Since FAFSA involves financial aid for college, high school seniors should fill it out, making sure they submit it for the 2024-2025 school year. Additionally, it might be surprising to know that there is no income limit for FAFSA, so only non-citizens or those with unsatisfactory (below 2.0 GPA) grades are ineligible to apply.

In an exclusive Wolfpacket interview with Richard Cordray, the Chief of Federal Student Aid, Cordray explained that FAFSA is beneficial to a variety of students.

“Anyone interested in attending any kind of post-secondary education, including community college, 4-year college, graduate school, or career or trade program who wants to try to qualify for loans or grants,” Cordray said.

In past years, the form has been known to be very tedious. It included excessive questions that took hours to do, so many chose to not fill it out. They believed that they would not qualify, so what was the point? In order to get more people to fill out the form and get the assistance they need, changes were made and the new version of the FAFSA was released to the public on December 30th, 2023. The number of questions was reduced from 108 questions to 46, so the form would be more efficient. Students can now add up to 20 colleges, which allows them to include all the institutions they wish to apply to. The portal was also simplified so students will only see the part they need to fill out. Demographic questions, including those about gender, cannot be viewed by parents or guardians, providing more security for students in unaccepting households. New questions were also implemented to account for other factors, such as family size.

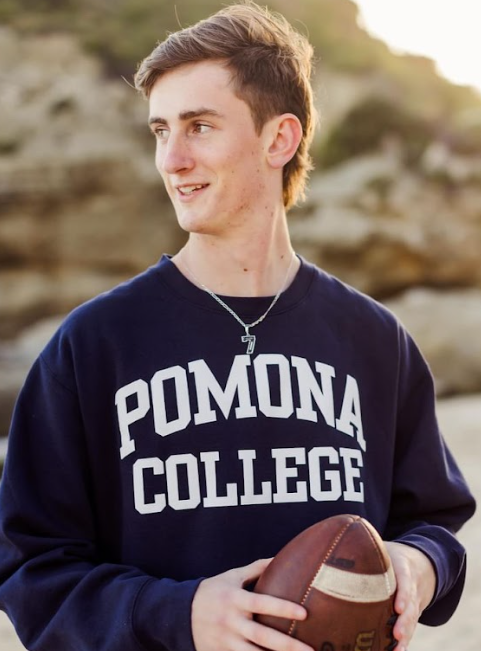

The changes that have been made so far have had positive effects on Claremont High School students. Senior Jordan Peng is one of many who has decided to fill out a FAFSA this year.

“I’m glad I filled it out,” Peng said. “I think those who believe they should fill out the FAFSA should. Even if you’re on the edge, then you should fill it out. I don’t think there are consequences to filling the form out even if you don’t receive any benefits.”

Many students like Peng have employed the same ideology and have already filled out the form in anticipation of getting into their desired school. Cordray has seen the results firsthand and expanded on the success so far.

“We are still in the midst of delivering the new FAFSA,” Cordray said. “So far, more than four million applicants have successfully submitted the new form, and we are working on processing their information so that schools can deliver the financial aid packages for next year.”

Filling out a FAFSA is truly the beginning for students to find a way to achieve their goals. Student debt is a massive issue in today’s society, with 43.5 million Americans currently facing the burden of repaying their debt. Graduating with debt only piles on decades of stress while dragging students down in the years following their college education. There are no costs to filling out the form other than a little bit of time. Students need to be aware of this potentially life-changing opportunity.

In closing remarks of the interview, Richard Cordray discussed the importance of high school students being aware and taking action by filling out the FAFSA.

“It is the key that unlocks the door to all the benefits of further education and training by helping make them affordable,” Cordray said. “That is good for students, their families, our communities, and our country.”